The Green for Growth Fund (GGF) is an impact investment fund partnering with various financial and non-financial institutions, which share the same outlook on business activity and sustainability. Using a blend of public and private financing, funds are channeled to eligible projects and companies through these local institutions in the fund's regions of operation. Augmenting the impact of investments made, the GGF Technical Assistance Facility is fully equipped to provide the the fund's partners with support and trainings, develop projects, and implement green technologies.

Using green finance initiatives which reduce CO2 emissions, energy consumption and resource use, profit and sustainability goals can be met simultaneously.

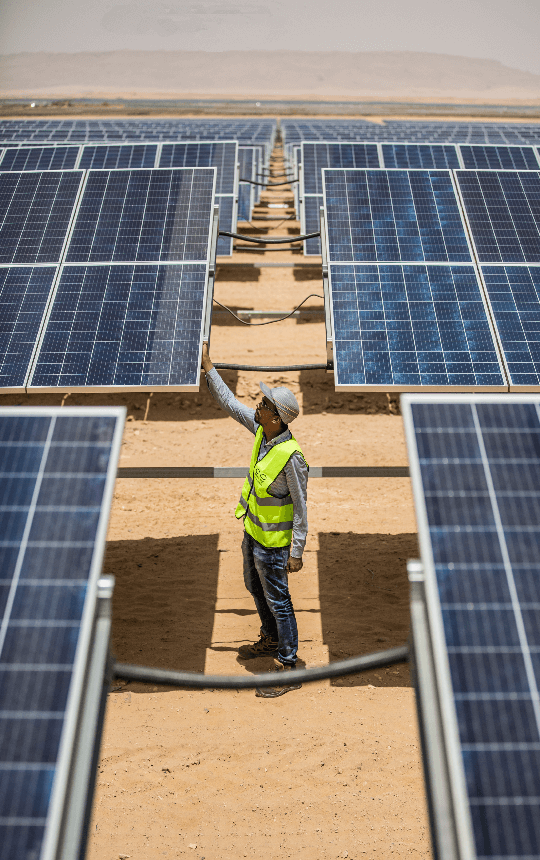

Below are some of the sample investees which the fund can finance.