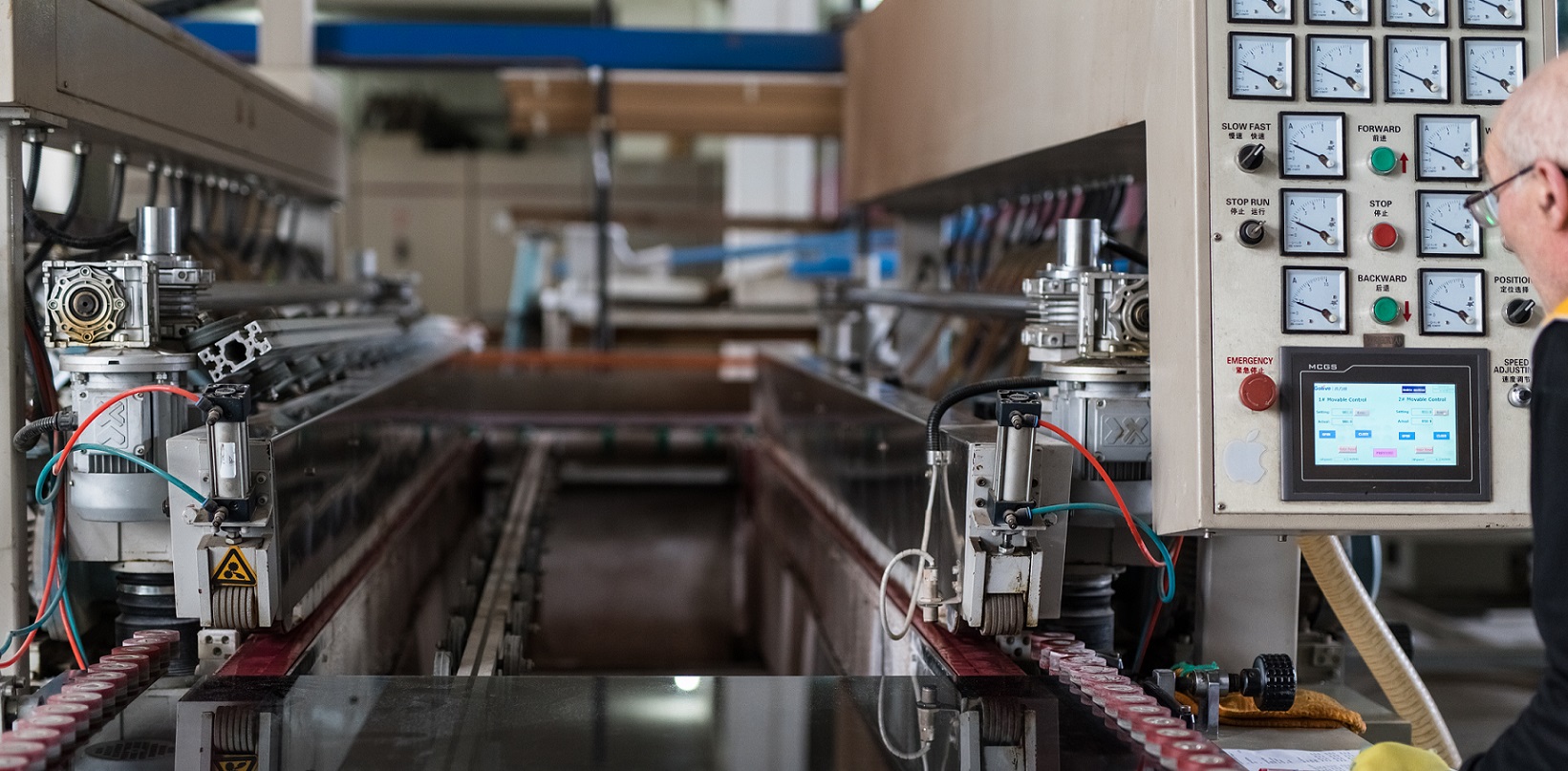

Since the Green for Growth Fund partnered with ProCredit Bank Serbia in 2016, its team has distributed more than €50 million in green loans to over 600 business clients.Through the financing of almost €300,000,00 in energy efficiency investments for small and medium enterprises, ProCredit Bank has enabled its clients to update their production lines and increase the efficiency of their operations and reduce costs.

This improved environmental performance has not come at the expense of business performance. In fact, through this modernization, ProCredit Bank has become an attractive partner for businesses by using green loans to help them gain a competitive edge.What is more, ProCredit Bank not only designs new types of loans for green purposes, but also devotes resources to awareness-raising campaigns and regular training for staff. This has enabled them to improve the environmental performance of the companies they work with and become a vital partner to clients, consulting them on how to improve their own sustainable.

Not only this, but they practice what they preach. ProCredit Bank has installed a solar power plant on its administration building and its fleet is already made up of 70% electric and hybrid vehicles.

This partnership demonstrates how environmental and business performance can go hand-in-hand.